Formula for e

Categories: exponentials

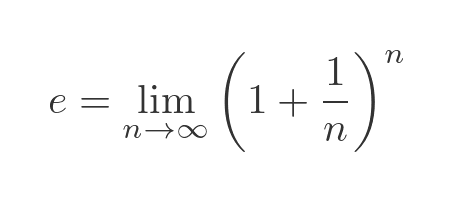

Following on from the article what is e, here we will look at the formula:

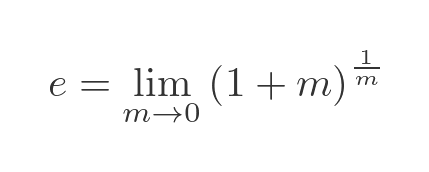

This formula can also be expressed by substituting m = 1/n. In that case, the limit as n tends to infinity is replaced by the limit as m tends to zero.

These two expressions are equivalent. But where do they come from?

Compound interest

The formula was first discovered in relation to the calculation of compound interest.

Suppose you had a bank account that paid 100% interest at the end of each year.

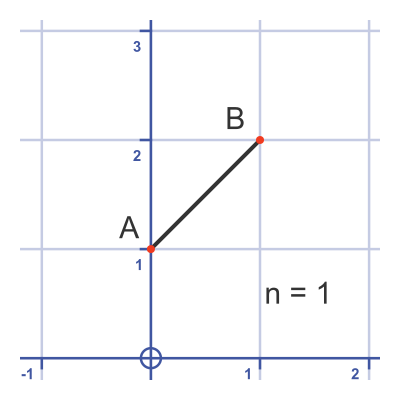

If you started out with £1 in the account, then after a year the bank would give you 100% interest, which means you would have £2 in the account. We can represent this as a graph:

Here, the x-axis represents time (in years) and the y-axis represents the money in the account.

Point A is the start, with £1 in the account. Point B is the end, after 1 year, with £2 in the account. The black line represents the interest that is being earned, but it doesn't actually get paid into the account until point B.

The slope of the black line is 1 because there is £1 in the account and it is earning 100% interest (so £1/year).

Now suppose that instead of paying 100% at the end of the year, the bank paid interest twice a year. They would only pay 50% interest each time, of course, because the interest is only for half a year. So:

- You would start with £1.

- After 6 months, the bank would give you 50% of the amount in your account, which is 50p. So your account would now contain £1.50.

- After another 6 months, the bank would give you 50% of the amount in your account, which is 75p (because you had £1.50 in the account at the start of that 6-month period). That would make £2.25 in total

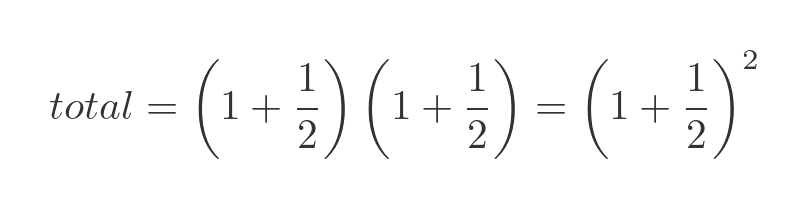

We can express this as a formula. Twice a year, we have interest added to the account that is worth half of the amount in the account. This is equivalent to multiplying the value of the account by one plus a half, and this happens twice, so the total amount is:

Here is another graph that represents the situation:

The line AB represents the growth of interest for the first 6 months. The slope is still 1, because there is £1 in the account, so you will be earning £1/year interest. Of course, this line only covers 6 months, so only 50p is paid into the account at point B.

The line BC represents the growth for the second 6 months. The line BC has a slope of 1.5 because you will be earning £1.50/year interest.

This is an important fact. The line section AB has a slope that is equal to the bank balance at time A. The line section BC has a slope that is equal to the bank balance at time B.

It is clear that getting paid interest twice a year results in a bigger bank balance. But what if the bank paid interest four times per year? In that case, they would pay 25% each time. So:

- You would start with £1.

- After 3 months, the bank would give you 25% of the amount in your account, which is 25p. So your account would now contain £1.25.

- After 6 months, the bank would give you 25% of the £1.25 in your account, which is 31.25p. So your account would now contain about £1.5625.

- After 9 months, the bank would give you 25% of the new balance, giving you a total of £1.953125.

- After the full year, the bank would give you 25% of the new balance, giving you a total of £2.44140625.

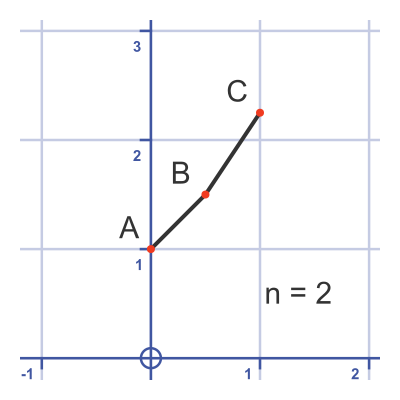

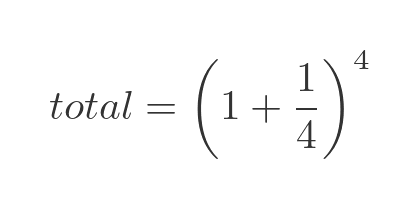

The formula this time is:

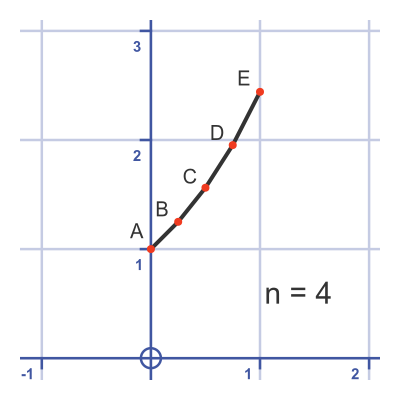

Here is the graph:

Once again, the graph gets steeper each time interest is added, and the new slope is equal to the bank balance at that point:

- The slope of the line AB is equal to the value of the bank balance at A.

- The slope of the line BC is equal to the value of the bank balance at B.

- The slope of the line CD is equal to the value of the bank balance at C, and so on.

More frequent payments

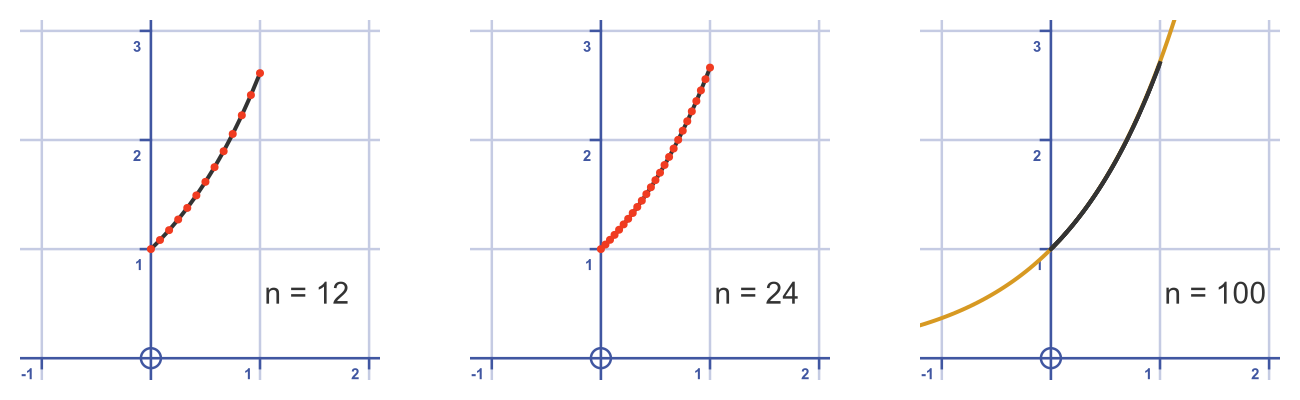

Here are some graphs indicating what happens when we use 12, 24 or 100 payments per year:

Each time we increase the number of payments per year, n, the final balance increases a little, but the increase is limited. As we noted in the article what is e, as n tends to infinity, the value approaches Euler's constant e, which is about 2.718281828459045.

Observations about the curve

The final curve, with n of 100, is starting to look a lot like a smooth curve. The larger we make n, the more steps there are in the curve, and the smaller each step, so the curve becomes more and more like a smooth curve.

This makes sense because as n gets larger, we might be updating the account balance with a tiny amount of interest every hour, every second, or every microsecond. We get closer and closer to the situation where the account balance is being updated continuously.

The curve looks very similar to an exponential curve of the form a raised to the power x, where a is the base of the exponential function.

We know that a to the power 1 is just a. Also, when x is 1, the curve has a value e. This means that the curve is the exponential function, that is, e raised to the power x.

We also know that at every point where interest is added, the slope of the curve is equal to the value of the curve.

The above is not a proof, but it indicates two things. First, as we increase the number of steps in a compound interest calculation, the solution tends towards a continuous function that obeys the rule:

And secondly, that a solution to that equation is:

We prove this result in the article Derivative of the exponential function

Related articles

Join the GraphicMaths Newsletter

Sign up using this form to receive an email when new content is added to the graphpicmaths or pythoninformer websites:

Popular tags

adder adjacency matrix alu and gate angle answers area argand diagram binary maths cardioid cartesian equation chain rule chord circle cofactor combinations complex modulus complex numbers complex polygon complex power complex root cosh cosine cosine rule countable cpu cube decagon demorgans law derivative determinant diagonal directrix dodecagon e eigenvalue eigenvector ellipse equilateral triangle erf function euclid euler eulers formula eulers identity exercises exponent exponential exterior angle first principles flip-flop focus gabriels horn galileo gamma function gaussian distribution gradient graph hendecagon heptagon heron hexagon hilbert horizontal hyperbola hyperbolic function hyperbolic functions infinity integration integration by parts integration by substitution interior angle inverse function inverse hyperbolic function inverse matrix irrational irrational number irregular polygon isomorphic graph isosceles trapezium isosceles triangle kite koch curve l system lhopitals rule limit line integral locus logarithm maclaurin series major axis matrix matrix algebra mean minor axis n choose r nand gate net newton raphson method nonagon nor gate normal normal distribution not gate octagon or gate parabola parallelogram parametric equation pentagon perimeter permutation matrix permutations pi pi function polar coordinates polynomial power probability probability distribution product rule proof pythagoras proof quadrilateral questions quotient rule radians radius rectangle regular polygon rhombus root sech segment set set-reset flip-flop simpsons rule sine sine rule sinh slope sloping lines solving equations solving triangles square square root squeeze theorem standard curves standard deviation star polygon statistics straight line graphs surface of revolution symmetry tangent tanh transformation transformations translation trapezium triangle turtle graphics uncountable variance vertical volume volume of revolution xnor gate xor gate